Pitch

Innovative financing for small-scale energy efficiency projects. Each penny saved is invested in a sustainable local community.

Description

Summary

Mainstream banking generally siphons-off funds from local savers into international (speculative) financial markets. The system is rigged against local lower-yield initiatives.

Zip/Zap finance is an attempt to rethink retail banking in such a way that household's savings remain local and serve penny-for-penny to create more sustainability in the local community.

In our vision on finance

- Households do not save to get richer, but rather to make their lives - and the lives of their children - more secure and more agreeable;

- Households that invest do not solely look at their personal financial return, but also at contributions to their community;

- Banking does not serve to create funding for international finance, but rather for those (local) projects that households truly care about .

As proof-of-concept Zip/Zap finance has devised a three step roadmap to roll-out this philosophy for small-scale Energy Efficiency investments.

The three steps are:

- Offering savers the opportunity to put aside "energy credits" rather then money, in an approach that gives them more certainty about their future energy bills;

- Use the energy credits collected to provide building owners with financing for their small-scale energy efficiency projects, in a way that gives them more certainty about financial returns of their projects;

- Set-up an internet market place where energy credits can be used to buy products and services related to energy efficiency from suppliers.

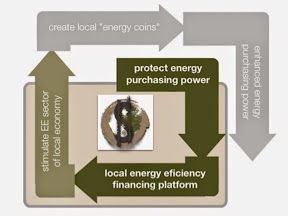

These three steps will create a positive spiral for ever more sustainability and ever more prosperity.

The process runs like this:

- help households that save protect their purchasing power against erosion by rising energy bills;

- help households that invest in energy efficiency liberate additional purchasing power;

- in the process create additional turnover for local businesses active in the domain of energy efficiency.

In doing this, we build a world where the object of finance is not money, but the things that money can buy.

Category of the action

Building efficiency: Physical Action

What actions do you propose?

Background

More is needed to combat global warming and reduce CO2. More behavioral change and more small-scale investments in efficient houses, efficient cars, modern appliances and on-site green generation. This forms the backdrop for the Zip/Zap approach to energy efficiency finance and represents the social opportunity.

Energy efficiency (= reduced energy use and increased on-site sustainable generation) is mankind’s and its planet’s most attractive option for a sustainable future. It reduces CO2 emissions, and unlike other options also lowers energy bills for end consumers. The market for investments in energy efficiency is huge. Most of the required investment is small-scale and must come from the private secor. Most of these opportunities lie in buildings and in mobility (cars).

Zip/Zap financing

Zip/Zap financing is an attempt to innovate the business model of retail banking to better serve the needs of micro- and small-scale investments in energy efficiency.

With Zip/Zap finance heating oil, electricity, gas, gasoline and diesel become currencies that can be:

- saved;

- borrowed to invest in energy efficiency;

- spent on products and services of specialized suppliers.

In this approach the object of banking is not money itself, but rather the things that money can buy.

Zip/Zap financing will be realised in three steps:

STEP 1: "Zip" energy

First, we create savings products where households, instead of putting aside money, can actually put aside forms of energy that they know they will still have a need for in the future (heating oil, gas, electricity and even gasoline).

Practically, households will have the opportunity to pre-pay future energy consumption, at today's all-in retail prices. But instead of consuming that energy, it will be accounted for on an energy account. As long as the energy remains in that account it will generate interest for the savers. Also, savers can always re-sell the saved energy, turning it back into cash. But most importantly, the energy saved-up also represents a claim on future consumption and can be requested to be delivered in kind in a future period.

Or in other words: savers will "zip" energy and store it for future use in (virtual) energy storage.

This "zipped" energy provides the main characteristics of normal savings products (interest, liquidity), but would also provide households with more control over and more visibility on their future energy bills. As such it takes away uncertainty and risks from what is still a major part of household's budgets. (And more in general, it might be an alternative for all savers/investors that seek protection against Consumer Price Inflation)

STEP 2: "Zap" energy

Second, we use the energy "zipped" in step 1 to finance small-scale energy efficiency investments with energy loans. Eligible projects include all projects that need investment to reduce energy use or to produce sustainable energy locally (building insulation, solar panels, heat pumps, mini-CHP, electric cars, etc.).

Practically, project owners would pre-sell their expected energy savings for the first years at today's all-in retail prices, against payment of cash. Such energy loan can then be paid back in the rythm that real savings will be realised.

One could also say that investors in energy efficiency will "zap" away future energy consumption by operating a (virtual) energy mine.

The energy loan approach takes away major risks and uncertainties from the project owners, by making returns on investment and payback period independant of retail energy price evolutions.

When we execute steps 1 and 2, we create a grassroots energy efficiency financing chain where households know that each penny they save will remain in the local community and will be invested to create more energy efficiency, more sustainability for the community. This will kickstart a positive spiral for ever more sustainability, but also for ever more economic activity and prosperity. The spiral starts by helping households that "zip" energy protect their purchasing power and it continues by helping households that "zap" energy create more purchasing power, while in the process also creating more turnover for local businesses in the energy efficiency sector.

STEP 3:

In addition, we want to operate an internet market place, where suppliers that offer products or services in the domain of energy efficiency (f.i. solar panels, energy scans, smart meters, insulation, etc.) can offer their wares for sale. Transactions will not be paid for in money, but rather in energy credits. In this way, energy "zipped" in (virtual) energy warehouses can be directly used to procure more energy efficiency.

This last step makes the positive spiral even stronger, because energy credits created in the financing chain will then not be used once, but can potentially be used several times for ever more energy efficiency!

Zip/Zap finance and our future

The Zip/Zap finance approach is the application in the domain of energy efficiency investments of EZ Fineants' vision on finance (in stark contrast with the traditional view). This vision is that:

- Households do not save to get richer, but rather to make their lives - and the lives of their children - more secure and more agreeable;

- Households that invest do not solely look at their personal financial return, but also at contributions to their community;

- Banking does not serve to create funding for international finance, but rather for those (local) projects that households truly care about.

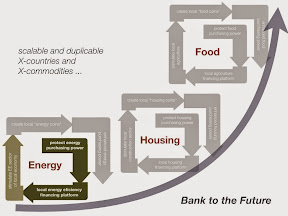

If the Zip/Zap finance approach proves to function in energy (efficiency), it also provides the proof-of-concept of the general principles. Principles that can then be used again to shake-up financing in other important areas of household's budgets:

- Imagine f.i. that young couples that save for a house would not put aside money, but rather housing credits. They would then be able to sleep well in the secure knowledge that the rythm at which they can save is not eroded by ever rising housing prices. Coupled, of course, to mortgages where buyers could also sleep well knowing that when the value of their house falls they also pay back less on their loans.

- Or imagine that households would - for part of their savings put aside not money, but baskets of local food stuffs. Coupled to loans for local farmers where farmers pay back less when food prices drop.

And that would create a different world. One where the object of finance is not money, but the things that money can buy.

Wouldn't that world be a more logical one?

Who will take these actions?

Governments and regulators:

- create/change financial legislation and regulation that establishes the legal basis for "saving energy" (Zip), "energy loans" (Zap), etc.

- idem for ensuring that Zip and Zap products are not in violation of laws and regulations in the utilities sector

- stimulate private initiatives from the banking and/or utilities sectors to develop a Zip/Zap finance approach for energy efficiency (or potentially from entirely new entrants)

- local governments can provide an important boost to any Zip/Zap finance initiative, by funding energy efficiency upgrades of their buildings trough this kind of finance approach.

Private enterprise:

- create (potentially in cooperation with government or government agencies) the necessary Zip and Zap products

- create local energy efficiency businesses and trade on the internet market against payment of "zipped" energy (see above)

Households:

Use Zip and Zap products to take control over their future energy bills. Appreciate that savings do not serve to get richer, but to make life more secure and agreeable. Invest in energy efficiency and feel good about themselves.

Where will these actions be taken?

Globally : Additional Energy Efficiency is needed worldwide.

Zip/Zap finance can be introduced per individual jurisdiction, though.

Developed countries should take the lead with Zip/Zap finance markets legislation.

How much will emissions be reduced or sequestered vs. business as usual levels?

Depends on success of zip/Zap financial products. Which in turn depends on legislative and regulatory facilitation of the approach.

Also depends on energy forms saved: electricity saves less CO2 per $ unit then gas; gas less then oils.

Could be huge, though, if Zip/Zap finance becomes the norm.

What are other key benefits?

Energy bill reduction for households.

Proof-of-concept that can be rolled-out in other areas of houshold's budgets (f.i. housing, food : also see above)

What are the proposal’s costs?

No upfront cost necessary.

Only requirement is legislative and regulatory flexibility to facilitate/approve/tolerate:

- in financial regulation: financial products (savings and loans) as per the above Zip/Zap products;

- in energy regulation: (quasi) energy sales/purchases as per the above Zip/Zap products.

Once legislative tolerance established, operators offering Zip/Zap products (could be banks, utilities or new players) would do so with profit motive.

Time line

Can be realised quickly, once legislative and regulatory framework in place. No other major hurdles for implementation exist.