Ross Collins May 23, 2014 11:17 |

Hey geoff thanks for your contribution, this is a very interesting proposal. Can you tell us where the $8/tonne CO2 carbon tax and the 6% interest rate on PACE bonds come from? In other words, why $8 and 6%, why not $20 and 4%? What might be the tradeoffs concerning the efficacy of the proposal if these figures were to be altered? How might it affect the costs?

|

Fanny Thornton May 26, 2014 04:01 |

Geoff, do you need to think about the political feasibility of your proposal? Would there realistically be an appetite for a 'tax'? In Australia, we have just had a government demolished over a so-called carbon tax. I think much in your proposal depends on how your concepts are framed.

Best!

|

Geoff De Ruiter Jun 11, 2014 08:09 | Proposal contributor

Hi! Thanks for the comments and questions.

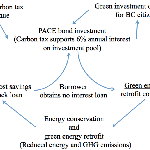

@rdc8j - The 8$ tonne carbon tax came from the original proposal which was more directed at the current British Columbia carbon tax. The BC carbon tax is offset through reductions in income taxes for individuals and businesses. There was a portion of the carbon tax (equal to 8$/tonne) that was unevenly redistributed back. We also thought that 8$ was a relatively low amount to start with, and that would be easier to gain support for. In the full proposal that we wrote it was assumed that in time the carbon tax would regularly increase in price. Of final point on the $8 per tonne carbon tax, is that A transition will take time, but at this point in time there are huge gains inefficiency and cost-effective renewable energies for implementation. Therefore the price signal to start can be low as there is lots of opportunity available right now.

Through much discussion and consultation we came to the 6% interest rate because it approximately matches a generous and conservative return on investment. Anything more might seem to be overly generous and anything less becomes uncompetitive for investments. Additionally, the higher the interest rate, the more capital from the carbon tax that is used up. This reduces the effective leveraging power of the bond and makes it less efficient on the side of government.

@fannythornton - I agree the political feasibility of implementing a carbon tax in some regions is quite low. I know very well the unfortunate situation which occurred in Australia. The British Columbia carbon tax was framed as revenue neutral for the government, carbon tax imposed and income taxes reduced. Granted BC is one of the more progressive provinces in Canada, but eventually carbon pricing (A better way of saying carbon taxing) is eventual in one way or another. This will come through regulation on industry which will have to raise prices, insurance rates being increased to offset the unpredictability when dealing with extreme weather patterns due to climate change, or my preferred because it allows us the capital to transition, A carbon tax that is used to facilitate our transition.

In all, we tend to forget that alcohol and tobacco are taxed for their social and health impacts. Essentially anything that has been demonstrated to cause harm eventually is taxed to recuperate the costs that are imposed on society, unless it is out right banned, which will not happen with fossil fuels. I feel that it is eventual that we will increasingly implement carbon pricing around the world. In many cases a carbon tax will be a permanent addition, however in some cases, such as Australia's, own political ideology will trump facts.

I hope I adequately answered the questions you had! And thank you for inquiring!

|

Felipe De Leon Jun 17, 2014 08:42 |

Hi geoff,

Thank you for the very interesting Proposal. I like the fact that you thought through the price setting element and into what should be done with the funding to maximize impact. How do you envision this actually being implemented? Assuming you had the political buy in tomorrow, what kind of institutional arrangement would you suggest to implement a carbon PACE bond?

Given the issues relating to political feasibility that fannythornton pointed out I suggest maybe picking a pilot region where it would be politically feasible to implement your concept and then think through what that would look like in practical terms, so as to come up with a pilot project (and a pilot project budget).

Good luck!

|

Joe Nyangon Jun 18, 2014 03:54 |

Geoff,

You also need to think about primary risks and potential mitigants for the carbon PACE bond, especially counterparty risk and cash flow/performance risks. How do you intend to address these risks? Also given issues related to institutional arrangements, how do you intend to implement the bond? PACE financing mechanism have faced opposition from some residential/commercial building owners.

Best!

|

Climate Colab Aug 5, 2014 08:20 |

1. Big fan of pace bonds but not sure what it has to do with carbon tax. Is the link that it would reduce interest growth rate on pace bonds to 0? A lot of people want to propose ways to spend the money, the question is does that improve or worsen the chances of a carbon tax/price being enacted? The author should think on this and expand appropriately in the second iteration of his proposal.

2. Author leaves me questioning what an $8 ton carbon tax and capital elicited from issuance of 6% bonds would achieve in terms of carbon emissions reductions. And who is to decide who gets the capital from the bonds? A new federal or state bureaucracy? And is 8$ enough to influence anyone to do anything? Please expand/justify further.

3. This is a well elaborated proposal that builds on existing work. The largest question market is the ambition of the proposal; an 8$ per tonne carbon price is seen by most economists as being insufficient to drive meaningful emissions reductions. How can you justify this number, from the literature, other reports, media, scientific papers, etc.?

|

Climate Colab Sep 3, 2014 12:21 |

Overall, the main weakness is it imposes a broad tax but concentrates relief to real estate. The increment is also very slow, and wonder how meaningfully this proposal would shift carbon pollution levels.

|