Pitch

Mitigating climate change in India by attempting to control demand side consumption of resources by using a unique progressive tax system.

Description

Summary

In this proposal, I attempt to address the market inefficiencies in India, that are the cause of resource exploitation and hence, contributors to climate change through a unique progressive taxing system for principally three common pool resources namely, water, food and electricity. This is imposed on demand side actors such as the final consumers of these resources, which are the people residing in the country and the businesses which provide the consumers with these resources in various shapes and forms. I concentrate on these actors because it is my belief that until the consumption of resource cannot be brought down to more sustainable levels, the effects of other policies towards tackling climate change can only be limited.

The uniqueness of this policy comes from the fact that it is attempting to impart an actual cost to over-exploitation, which for resources like food and certain energy sources like fossil fuels, is new. It also amends some of the drawbacks of existing policies for resources like water and electricity, which are not fair to various groups of consumers and hence cause a loss in their efficiency. Finally, the system offers flexibility in the way resources can be used so as to incentivize the use of more low impact resources and adopt more sustainable technologies and practices.

The system is also incorporative of behavior change inducing methods such as comparison of individual consumptions through mobile apps or social media, many of which have been discussed in Climate Colab, because a key aspect of this system is providing means for monitoring of one’s consumption throughout the year so as to allow planning it in such a way that minimizes their total tax incurred.

Finally, throughout my investigations, at least to the level described in my outline, I foresee no technological or practical barriers that can seriously impede the implementation of this policy. All of the technology and practices required for this policy to work are already in mainstream usage.

Which proposals are included in your plan and how do they fit together?

Introduction and Inspiration

With the world’s population projected to rise to 9.7 Billion by 2050 [1], it is going to be, quite possibly, the biggest challenge for the world’s governments to efficiently distribute their already dwindling, and mostly ill-managed and overexploited supply of natural resources amongst their people without causing any further harm to the environment. For India, this will be made more challenging by the fact that it is projected to lead the world in population within the same timeframe[1] and also because, currently, it is in a phase of rapid economic and social development which is highly dependent on mass consumption of natural resources. Due to this, it is not difficult to envision a future in which Indians will not only experience the massive crunch of fuel and food shortages (to an extent, we already do) but also suffer from an extremely polluted environment which is already showing signs of being severely stressed [2].

The difficulty with tackling this issue is not that adequate methods or technologies don’t exist or that there isn’t enough awareness within the general population regarding this problem. There is no argument that these areas require much work and are quite a long way off from achieving their respective goals completely, but there exists is a huge gap between the results that can be obtained with the solutions already at our disposal and what is seen in reality.

This gap primarily exists because current economic policies do not have provision for a more wholesome accounting of the cost of a natural resource, and also, do not provide adequate push for serious adoption of green practices and technologies. This inadvertently incentivizes the circumvention of the problem of climate change and over-exploitation of natural resources therefore, allowing the people to free ride on the environment.

Several policy reforms have been made by the government predominantly in the supply side and in certain areas of the demand side such as large industries, to address these market inefficiencies [4]. This bias towards some sectors is not difficult to understand, since they tend to be significantly large single point consumers and emitters, and are relatively limited in number hence making it easy to identify them, which makes it is possible to employ relatively simple policies to achieve significant reform.

Such policies are very crucial in India, especially in areas like the management of the country’s coal-fired power plants which are in such desperate need of upgradation [3] that even a basic policy mandating installation of few basic technologies would yield significant reduction in emissions and bring them closer to global benchmarks, but it cannot keep depending on them to solve all of its environmental problems.

This is because these policies are only targeted towards what can be considered as low hanging fruits which when achieved, will render the effectiveness of such policies mute. Also, to truly address the problem of reducing environmental impact on the country, we will have to focus on reducing consumption from other demand side actors namely, the country’s citizens and other small businesses as well, for which there is inadequate provision in present policies. Ultimately, since such policies focus mostly on a limited number of actors, they can only provide a solution space which, I believe, is too small to solve such a complex and dynamic problem.

Up until now, the most prudent way of bringing reforms in the demand side has been through the implementation of fiscal policies, such as subsidization of certain technologies to incentivize their adoption and imposing flat taxes or slab pricing on certain resources. While such measures do address the issue to some extent, they are largely limited by their lack of specificity. Such policies actually end up unfairly hurting people depending on which income bracket they fall into and the people who are actually judiciously using their resources because it is difficult to differentiate such individuals from source.

Another favored way of attempting to reduce demand side impact is through raising general awareness. While educating the people about the consequences of mass consumption and climate change, and the possible remedies is critically important, depending on it alone to bring about significant reforms is optimistic. There is credible research showing that it is not sufficient to appeal to the goodness of hearts, morals or judgements when it comes to conserving common resources; one also needs to impose direct incentives and punishments[5] to achieve worthwhile reform. But to do this, it is necessary to be able to identify each actor and his/her actions.

This is now possible with the advent of the “Aadhar”, which is issued by the Indian government and provides the ability to identify each person who resides in the country through a unique 12-digit number [6] and can be carried on a person as a card on which it is printed. It is also readable through a QR code, bar code or a chip embedded in the card (depending on which version of it one possesses). It has already reached the hands of about 74.52% of people [7] in India and is soon expected to reach full coverage.

In my proposal, I put forth an outline for a progressive taxing scheme that provides incentives and punishments on the demand side based on their behavior for primarily three resources namely, energy, water and food, and relies on a person’s “Aadhaar” which is linked to his/her income tax to work.

Though I discuss about the implementation of this system in India, this is possible in any country which has a national identification number system and an income tax system in place. Also, I discuss only three resources, but others are definitely possible; as I have stated before, this is only an outline and requires significant in-depth work before it is implementable. Finally, this system is not meant to replace all of the above mentioned policies, but only some on the demand side. It is incapable for tackling climate change without the rest in place.

Outline

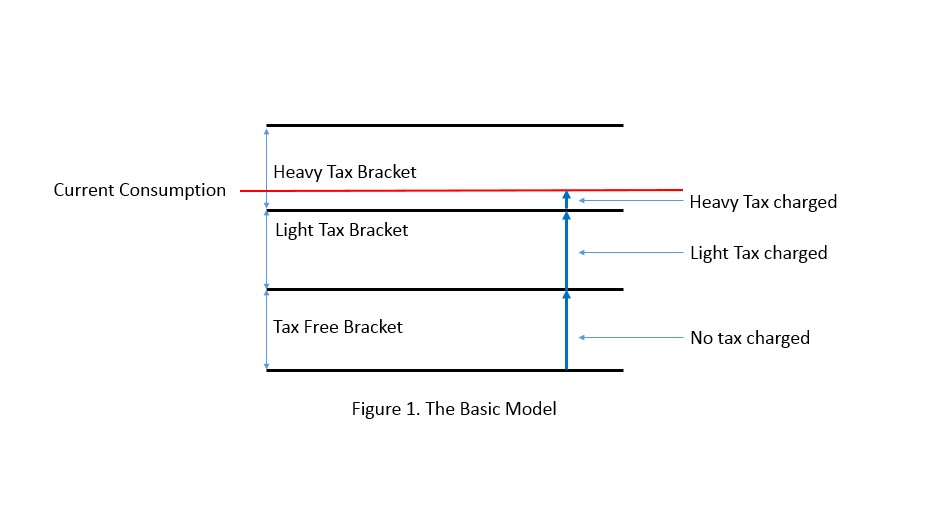

Like any other progressive tax system, the tax rate in this system increases in steps as the taxable consumption increases of each resource as shown in figure 1. The size of the brackets and the tax rate for each bracket can vary as per the individual’s income, or the profit margin of the business and the exemptions s/he/it is eligible for. The final amount after taxing in this system is added to the income tax and is retrieved from there. This is where the resemblance in the system as employed for the individual and the businesses cease.

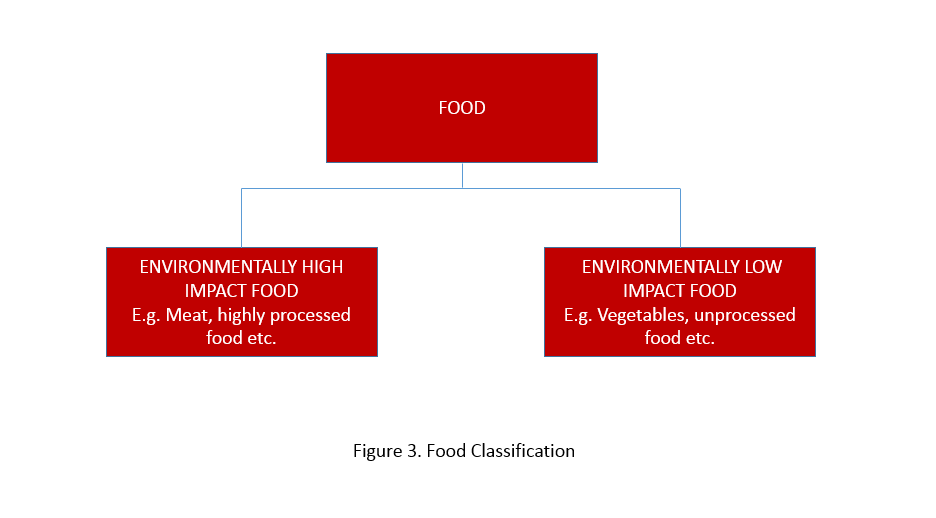

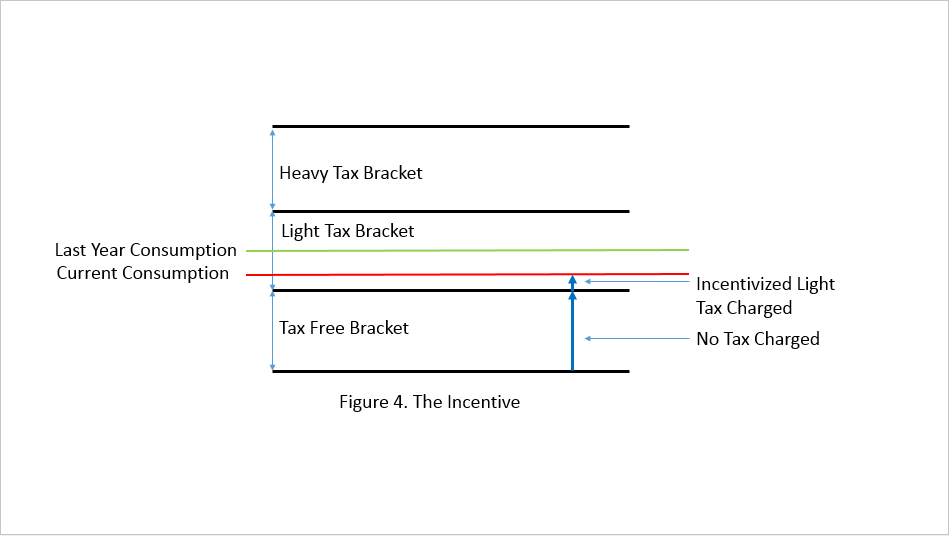

For an individual, all resource categories except water (water here implies municipal supplied water), are further classified as shown in figure 2 and 3. The system records the individual’s consumption of each classification within a resource in the previous year to enable a provision of an incentive which will be a certain percentage in reduction in the tax rate for each bracket for how many unit s/he consumes under the previous year, as shown in figure 4. This is designed to prevent the individual from resigning to the tax imposed by the system, and provide incentives for employing latest practices and technologies to reduce their consumption.

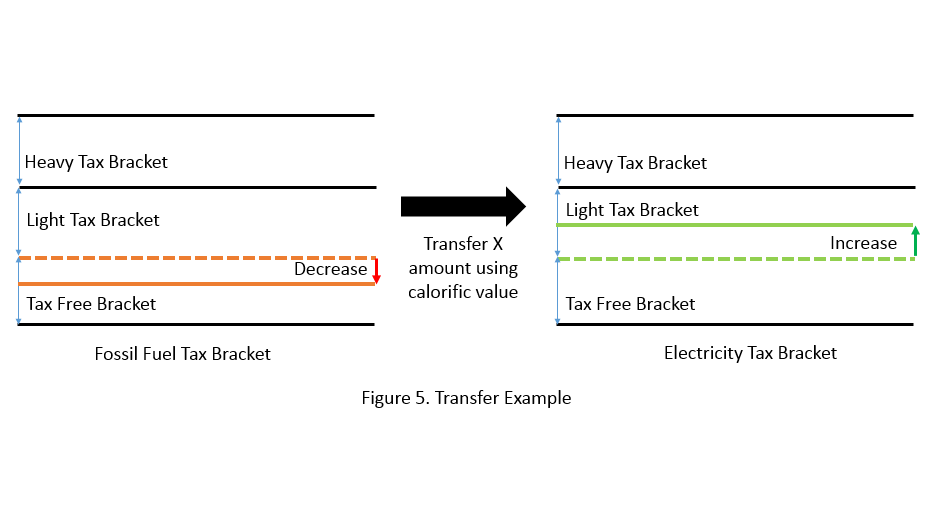

As shown in figure 5, the system also has the ability to transfer between classifications under a resource, the amount of tax free consumption allowed for each classification. This transfer is based on the calorific value for energy and calories for food and is done at the beginning of each fiscal year. This is enabled to accommodate for an individual’s preference of consumption in both those categories. This also incentivizes the use of more environmentally friendly resources as they tend to have lower calorific value (electricity) and calories (vegetables etc.) thus, enabling them to have a more fluid no-tax bracket than the more environmentally degrading ones. With respect to food, this system also has another advantage as it encourages the consumption of vegetables and other low impact food over high impact foods like meat etc. which are linked to obesity [8] and have shown to have an appreciable effect on climate change [9].

For businesses involved in trading of above resources, the resources have the same classification, but they are not taxed depending upon their consumption but upon the amount they waste. Resources like food [10], are wasted to a significant degree even before it reaches the hands of the individual because of transfer and storage inefficiencies. This setup will incentivize the methods and technologies which can minimize waste through such means. This will also prevent the business from circumventing this tax system and selling a good without recording it, as whatever is not recorded by the system as a sold commodity, or as stored will be considered a waste. A resource can be sold without the buyer’s “Aadhaar” card but will then be subjected to highest possible tax which is recorded by the seller and the tax is later claimed by the government.

This system is also self-imposing, as the linking of the “Aadhaar” with the income tax necessitates that when the business files its income tax, it has to also incur the tax from this system thereby, automatically including it into the system. As a consequence, evading this system would require tax evasion which is punishable by law. This frees the government from making many new legal frameworks for the implementation of this system.

Implementation

Any resource which is bought or sold, gets recorded through both the exchanging party’s “Aadhaar” into their accounts. This is easily possible through a registered card/bar-code/QR-code reader in a fashion similar to the way credit cards readers transfer information of purchase after shopping. If such devices do not exist (e.g. small “kirana” stores), or if the business is mobile (e.g. taxis), even a registered basic cellphone can be used to enter the purchase much like how mobile talk-times are purchased through phones. Resources like electricity and water can be directly measured off meters which are registered to the consumer as is standard practice in the slab pricing system.

Exemptions

Several exemptions can be made available to the demand side that can benefit them and the environment. This system promotes the usage of these provisions by allowing them to be applied on the income tax as well, once all the tax from this system is exempted. Some of the possible exemptions can be extensions of tax brackets for up to two children, subsidies on buying the card-reading equipment and on constructions based on LEED guidelines, and exemptions on using public transport and on the amount spent for funding projects aimed at protecting identified forests and endangered species. This space in the system gives ample room for many other points of environmental concern that need to be incentivized but are not in the current regime.

Monitoring

A user can regularly monitor his/her consumption using an online portal or through an app on smart phones, or even through a basic phone much like how one can check his/her mobile talk-time balance. This will enable the consumer to check his/her consumption throughout the year to regulate his/her consumption. They can even share this information on social media to enable games that aim to reduce consumption. Such comparisons have shown to induce behavioral change as shown in previous climate co-lab proposals [11].

Figures

Explanation of the emissions scenario calculated in the Impact tab

What are the plan’s key benefits?

Attempts to reflect the true cost of targeted resources and the environment.

Addresses the exploitation of fossil fuels.

Addresses the problem of excessive wastage of food and eliminates the need for implementation of fat taxes or mandating laws forbidding wastage of food from grocery stores and restaurants.

Provides monetary incentives for environmentally friendly practices and behavior

Creates a revenue stream which can be used by the government to achieve national environmental goals and fund research in the fields concerning the environment and climate change.

Ability to effect all sectors of the Indian economy that generate emissions.

Ability to induce positive behavioral changes in consumers towards the environment and resource consumption.

Requires less legal framework to be drawn up for implementation as it comes under the purview of the income tax system.

Versatile, as it can be implemented in any country with a national identification number system and a tax system

What are the plan’s costs?

The biggest cost incurred by this system would have been the distribution of the unique identification number to every residing individual in the country. This has already been achieved by the distribution of “Aadhaar” and hence, that cost is already sunk.

The other major cost of this system is providing server space for storing all the information, computing power for all the necessary calculations, and front end necessities required data input and monitoring. This can be estimated through the total budget allotment for IT services required by UIDAI for the implementation of “Aadhaar”, since it is the only other recent national level plan which has required comparable IT services to make it feasible. The cumulative cost of this, up until March, is about 725.26 crores as capital investments (approximately 5.7 rupees or 0.086 USD per citizen) and 693.06 crores (approximately 5.4 rupees or 0.082 USD per citizen) as revenues [12].

What are the key challenges to enacting this plan?

The biggest challenge for this policy would be to garner enough political will to bring about its implementation. There is also the issue of privacy, as some consumers might feel this information can be used by various parties for their own purposes especially against their favor. As long as the government upholds its promise of keeping all the data secure, this should not be a huge hurdle. In fact, this issue is already being discussed on a national level because of the privacy concerns raised against the "Aadhaar". This policy will piggyback on the outcome of this discussion, which in most likelihood will be implementation of strong laws designed to protect all the collected information from unauthorized surveillance and misuse.

Finally, it is important to calculate all the proposed brackets, and decide on the classification of the resources in a scientific manner so as to avoid bias of any kind creeping into the system.

Timeline

It is difficult to assess a timeline for such a policy, but it is reasonable to assume that it can be implemented in less than a decade after all the necessary calculations are performed and all the rough edges are knocked out. This assumption can be validated by observing the time taken by an equally complex policy to be implemented, such as UIDAI's "aadhaar" distribution, which has achieved a significant majority of its goal within seven years of its inception.

Related plans

All proposals at Climate Colab that aim to reduce or/and monitor the targeted three resources can be related to this proposal as they will, in some way, help the consumer meet their target consumption level to minimize the tax imposed on them.

References

1. United Nations, World Population Prospects: The 2015 Revision

2.http://www.nytimes.com/2015/08/17/opinion/india-finally-faces-up-to-an-ugly-reality.html

4. Govt. of India (2014). The final report of the expert group on Low Carbon Strategies for Inclusive Growth

5. Fehr, E., and Simon G. (2002). "Altruistic punishment in humans." Nature

6. https://uidai.gov.in/what-is-aadhaar.html

7.https://portal.uidai.gov.in/uidwebportal/dashboard.do

8. Wang, Youfa, and May A. Beydoun (2009). "Meat consumption is associated with obesity and central obesity among US adults." International Journal of Obesity

9.http://www.scientificamerican.com/article/global-shift-obesity-packs-serious-climate-consequences

10.http://www.nytimes.com/2013/10/15/opinion/how-to-feed-the-world.html?pagewanted=all

12.https://uidai.gov.in/finance-budgets.html